JULY 2019 WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

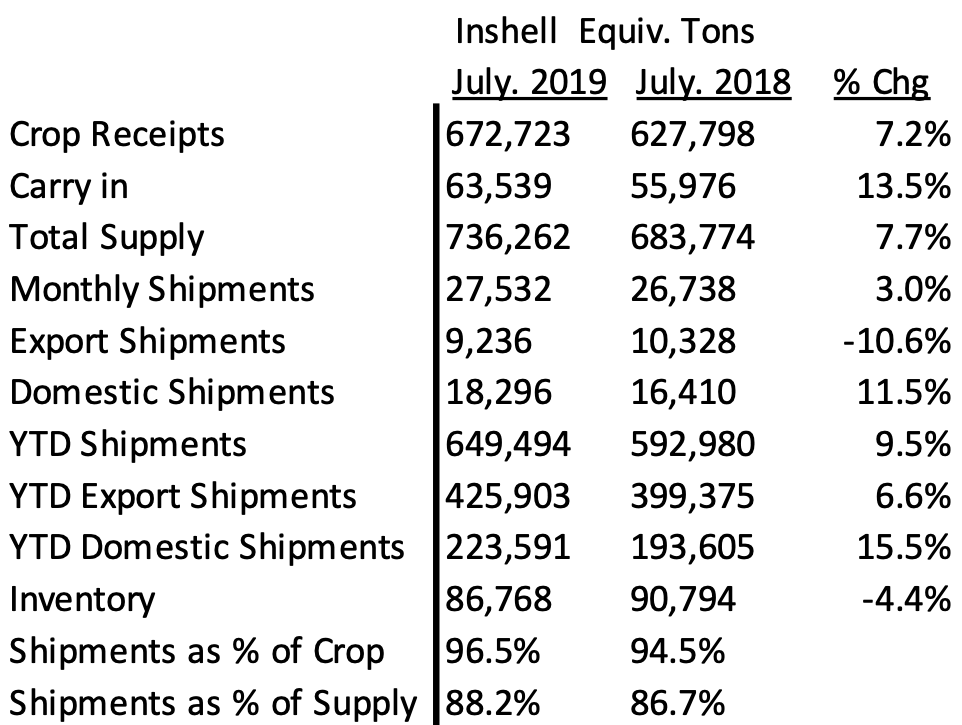

The California Walnut Board released the July 2019 Position Report. Our table of these figures are shown below:

MMR and YTD HIGHLIGHTS

1) Monthly inshell equivalent shipments +3.0% vs. PY

– Export inshell equivalent shipments -10.6% vs PY

– Domestic inshell equivalent shipments +11.5 vs. PY

2) Year to date inshell equivalent shipments +9.5% vs. PY

– Export inshell equivalent YTD shipments +6.6% vs. PY

– Domestic inshell equivalent YTD shipments +15.5% vs. PY

MMR DISCUSSION

The Calif. Walnut industry was up +3.0% in JULY 2019 over PY with only the month of August remaining in the 2018-2019 season. It is almost a given that August’s shipments will be near 25,000 ton and that “carry out” inventory will be less than the “carry in” beginning inventory. Thus, the industry will have moved over 100% of the crop which is very impressive.

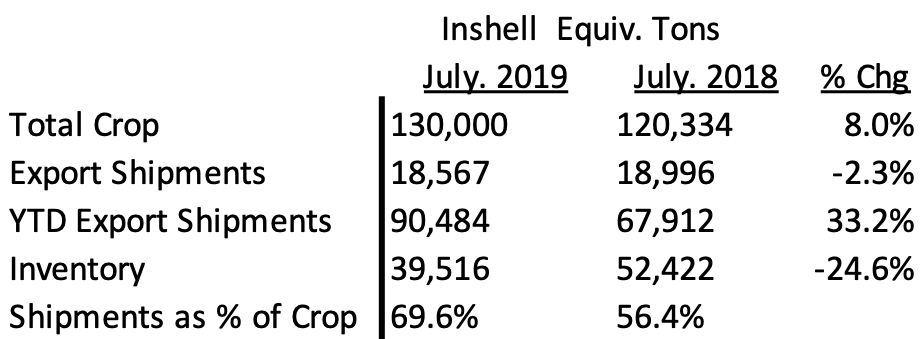

CHILE

This time last year, California had to compete substantially with Chile for early sales as well as into new crop, hence very cheap inshell prices to Turkey as low as the mid $.80’s/lb level for Jumbo Large Chandler natural inshell were available. Here is a snapshot of where we are with Chile compared with this time last year:

Chilenut released July Walnut Position report with shipment of 18,567 tons compared to last year of 18,996 tons a decrease of 2.3%. July shipments are 33% lower then June’s 27,652 tons. For the month of July 2019; UAE down 78%, Turkey is down 78%, China up 319% and India up 10% compared to last year. YTD shipments are 90,484 tons compared to 67,912 tons last year an increase of 33%.

Only few loads are available in Chile, inshell Chandler 32/34mm at $3.20/kg CFR and 80% LHP at $9.00/kg CFR. Both Dubai and Turkey both reporting low inventory of Chilean walnuts in bonded warehouses and cold stores. So far Chile shipped 70% of their crop. Remaining inventory is only 39,000 tons and this could take another 2 months to clear the inventory. By September Chile could have all their walnuts shipped giving California the control of the walnut market. Bottomline, Chile is low on inventory and if Turkey wants to play ball, they will have to come to California to play. There were few loads shipped in July from Chile to either Turkey (39 loads) and Dubai (18 loads) and next to nothing on the books to ship in August out of Chile. Cold storage holdings and bonded warehouses in Turkey and Dubai are empty. This really bodes well for California.

SUBJECTIVE AND OBJECTIVE ESTIMATES

The current unscientific subjective estimate is 691,000 inshell ton and the USDA estimate is due to come out at the end of August. That number will be more scientific than the Subjective which is just an average of a large number of packer estimates. The end of the month Objective is critical and will go along way to pushing the market one way or the other or maybe solidifying existing prices.

Inshell Prices

Inshell prices for Jumbo/Large Chandler have a large influence on the kernel market. Inshell jumbo/large Chandler opened up about 6 weeks ago in the $1.15/lb level and have reached $1.25/lb easily with some packers trying to now sell at $1.30/lb. Due to this inshell price and the packer mentality of trying to “equate the same return to the grower whether the sale is Inshell or Kernel”, Chandler LHP 20’s are in the $2.95/lb to $3.05/lb range. Domestic LHP in the $2.70/lb to $2.75/lb range yet no word on Combo Halves and Pieces to report.

Existing Inventory – Most inventory remaining is odds and ends with some deals occurring to turn these odd lots into cash or to clear out warehouses and finalize grower payments. Next to no Chandler straight halves left, a few loads of Chandler LHP and little few loads of domestic LHP or CHP remain.

US Trade Mitigation Program

Just hitting the street on 8/8/19 is the latest USDA Trade Mitigation program for walnuts. Quantity for invitation is 453,744 cases of 24/1lb product or 10.9MM pounds for shipment October 2019 through April 2020. This program for walnuts significantly helped move tens of millions of pounds of walnuts in the 2018-2019 season and is anticipated to be a constant program for the 2019-2020 season.

Conclusion – The 2018-2019 is largely over. They will move the entire crop and this feat was impressive. Chile is virtually out and two large users, Turkey and Dubai are empty and looking to buy inshell but at what price? The Objective estimate will come out late August 2019 and this number is very significant and will be very telling. What is this number? The USDA Trade Mitigation will help the industry get off on the right foot. Will there be more programs throughout the season? The California Walnut Handlers are hanging their hat on the Inshell Chandler price and using that price to calculate kernel prices yet they know you cannot sell the entire crop as inshell. We’ve also seen the industry when there is competition from other handlers and the pressure of 20 loads of incoming nuts from growers lined up down the highway and what that can do to their prices. Limited space and cold storage is an issue and that will be a contributing factor to prices during the season. But, just when you think you have it figured out, just like when the almond estimate came out, that sinking feeling can hit again.