SEPTEMBER 2020 WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

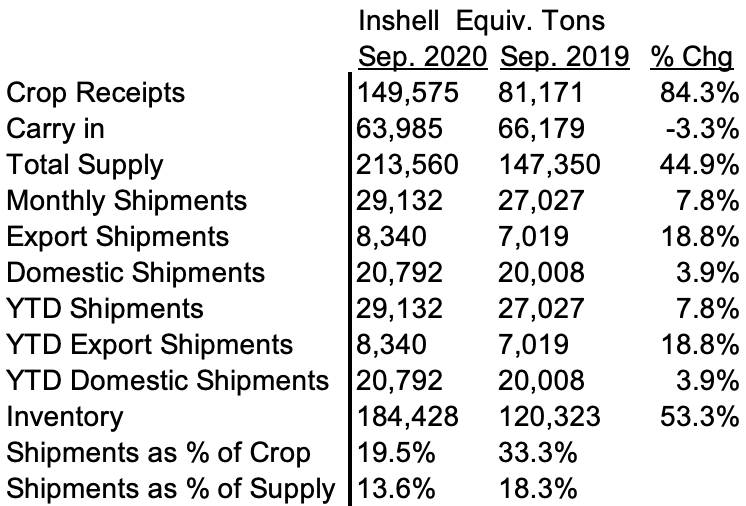

In the past week, The California Walnut Board released the SEPT. 2020 Position Report. Our table of these figures are shown below:

MMR and YTD Numbers are the same

This is the first month of the 2020-2021 walnut season so it is hard to gain any insight in trends from the first month of sales with some packers not even cracking in the month of September. Quality is overall reported to be good with only moderate amounts of combo as part of the crop. Packers are reporting that early Chandler kernel prior to going into the dryers look excellent but have gained an significant amount of color after coming out of the dryer so don’t be enamored with “before dryer kernel quality” as it can be deceptive.

Monthly inshell (total) equivalent shipments +7.8% vs. PY

– Export inshell equivalent shipments +18.8% vs. PY

– Domestic inshell equivalent shipments +3.9% vs. PY

For September, Italy, Spain and Turkey got the early jump on inshell which is to be expected with Inshell sales up 41.2% over PY. Kernel sales up 7.76% over PY with Germany up 80%.

Covid-19

At the time of this writing, Covid concerns still abound as many European countries, the USA and India are experiencing a 2nd wave of outbreaks. The USA had an additional 58,181 new cases (the highest was about 78K in Late July), India 60,365 new cases (the highest was about 95k in mid-September), Italy had 8,804 new cases (the highest so far), UK 19,000 new cases (the highest so far), Russia 13,754 new cases (the highest so far), Spain had 13,318 new cases (the highest was about 14k in mid-September), France had 30,621 new cases (the highest so far). There does not seem to be a mellowing of the virus and until there is a vaccine, the virus seems to be a part of life that may continue to plague the world for many months to come. There is talk of adding new shelter in place restrictions in Europe and there has been some discontinuance of clinical vaccine trials by the large drug companies as patients became sick during the trials. The economic impact going forward is unknown but for sure will be detrimental.

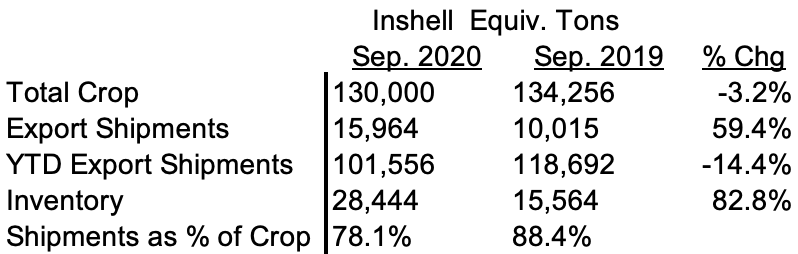

Chile

Chilenut released September Walnut Position report with shipment of 15,964 tons compared to last year of 10,015 tons an increase of 59%. For the month of September 2020; UAE up 48%, Turkey up 209%, China up 333% and India up 258% compared to last year. YTD shipments are 101,556 tons compared to 119,692 tons last year a decrease of 14.4%. Chile so far shipped 78% of their crop and needs to ship additional 28,000 tons for this season. Chile is virtually sold out all inshell and kernels. Most factories are expected to shut by end of October.

New Crop Inshell Prices and Kernel Prices

While the Independent Walnut Handler’s Coalition did not set a price at their August 12th meeting, we seem to have settled into a groove with the following prices for October 2020 sales: J/L Chandler’s $.90/lb, Jumbo Chandler $.95/lb. New crop Chandler LHP 20’s currently in the $2.25 to $2.30/lb range. New Crop Domestic LHP is $2.10 – $2.20/lb range and Combo Halves and Pieces in the $1.95/lb to $2.05/lb range. Chandler halves are in the $2.55 – $2.70/lb range.

What We Know and Don’t Know

– The 2019-2020 crop is final at 653,000 ton but the carry out was only 63,985 ton well under the predicted 80,000 ton carryover and mostly due to a revision down of the final shell out rate to 42.6% down from 44% which was estimated by the Walnut Board in prior reports.

– Shipments during the 2019-2020 first two months last year were approximately 120,000 ton which means that if we ship the same amount this year in these same two months, this would not even use up the increase in this year’s estimated tonnage of 130,000 ton. The remaining 10 months last year averaged 51,000 ton to leave a carryout of 64,000 ton. This year, you’d have to average 66,000 ton to leave the same carryout.

– From a the packers standpoint, there are the “haves” and the “have nots” and the two camps will indelibly affect each other the rest of the season. The “haves” are those that are comfortably sold, well over 50% and some as high as 70%. The “have nots” are those that are not well sold, do not have a great marketing strategy or well received brand name and have to compete on price more often than not. Most of these have not packers are well under 40% sold and will have to hustle to move product, not run out of bins or space and to maximize cash flow for anticipated grower payments. Cold storage season will be hard on any of these packers that have large amounts of product in April/May 2021 Cold Storage season.

– We are very confident that there will be more significant and numerous walnut buys by the USDA under their Trade Mitigation Programs or their Section 32 buys. The US Government has been lobbied hard by the Walnut Board to help offset the increase in tonnage and this should continue.

– Packers have told us that they are gaining more confidence in the 780,000 ton estimate with some even saying that the yield levels this year were surprising and could push the actual crop over the estimate

CONCLUSION

While the season seems off to a good start, we know that the main packers we deal with are pretty comfortably sold because they were pretty aggressive after the California Independent Handler’s Coalition did not come out with a price on August 12th. What we don’t know is where the others packers stand that we are less familiar with and what they will do to move crop. We are a bit concerned over quality due to numerous packers alerting us to the Chandler issue of darkening color after coming back from the dryer. Hopefully that will absolve itself as more crop comes in. The average monthly sales number to move the crop is big and we don’t know if current prices are low enough to move the crop and leave a normal carryover or if they are plenty low enough. Do lower prices get buyer to buy or get them to hold? At this point it is all about confidence with buyers and most buyers would be seem to be conservative in booking any contracts with their volumes tenuous. We also know that the walnut industry and the packers within so not operate well in a “hand to mouth market”. Packers, especially the large ones, have huge grower payments that while staggered are still massive and have to be planned and anticipated. We’ve hear that some growers have already started to try to extend bank lines of credit and negotiate with their banks in a year where they would be lucky to break even. Hopefully October sales are at least a 95,000 – 100,000 ton month and then hopefully the average rest of the months can approach 66,000 ton which seems very significant in the world of Covid-19. California will have its work cut out but how much pain is left that it can take with prices already over $1.00/lb less than this time last year on a kernel base and $.40/lb less on an inshell basis?