April 2021 WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

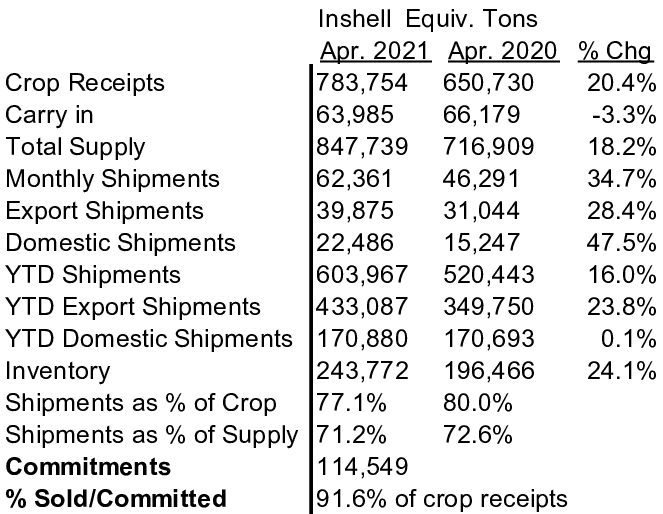

The California Walnut Board (“CWB”) released the April 2021 Position Report. Our table of these figures are shown below:

MMR

This is the 8th month of the 2020-2021 walnut season. This will be a very short report due to the starkness of the information. There will be no use going through many of the percentages for various countries as the chart above says it all. While the crop is up 20%, total shipments are up by 16%. Adding in commitments, the industry is 91.6% shipped/committed.

Receipts are 783,754 inshell ton compared with the prior year at this time of 650,179 inshell ton and compared to the estimate of 780,000 ton. Shell out rate is estimated at 43.7% this year versus 42.6% last year. This shell out rate is a 60 month rolling average so the attached March 31st Walnut Inventory document put forth by CWB tries to get closer the real inventory.

This is also the first time that the CWB has added information about “commitments” similar to the Almond Board of California report. This information is extremely helpful but we know three packers that did not submit “commitment” number for this report and there are probably more thus making the stated commitment of 114,549 inshell ton maybe a bit understated. Nevertheless, as of the writing of this report, the CWB reports Purchase Commitments of 7,615,843 inshell pounds (equivalent to 3,808 inshell ton) and 96,787,866 shelled pounds. To convert shelled pounds back into “inshell tons” the math is as follows 96,787866 / 43.7% = 221,482,531 pounds, divided by 2,000lbs = 110,741 inshell tons. Total Commitments on an Inshell Ton basis is 114,549.

There are two ways to assess this commitment number. We can merely subtract this from the extrapolated inventory in our chart of 243,771 – 114,549 = 129,222 available to sell. Therefore, as a % of the Crop, the Walnut Industry is 91.6% sold/committed. If we use the actual March 31st inventory report showing 313,569 inshell ton minus April inshell equivalent shipments of 62,361 inshell ton minus Total Commitments of 114,549 = 136,659 remaining inventory if we start by using the March 31st inventory report. So for simple math, 847,739 inshell ton inventory and unsold inventory of 136,659 leaves 711,080 shipped/committed tons which is 83.9%of total supply and 90.7% of the crop. This is close to the 91.6% in our chart so we will call it even.

Bottomline, using our charted number above, the industry is 91.6% sold/committed. This explains a lot about why the industry was reacting and performing the way it had the past couple months. Packer’s knew that April shipments were brisk as the backlog of unshipped goods was dwindling. May 2021 shipments will most likely follow suit with strong year over year shipments. Packers are at a point where they are finally assessing their contracts and their inventory and trying to see what “extra” they have. Offers will be limited until they figure out where they are at.

Current Inshell and Kernel Prices

Prior to the CWB report, prices were approximately as follows: Chandler LHP 20’s currently in the $2.50/lb range with limited supply. Domestic LHP is $2.25/lb to $2.35/lb range. Combo Halves and Pieces in the $1.85/lb to $1.90/lb range. Chandler halves not available. Most of the inventory remains in the form of Domestic LHP and CHP. Where will prices be after this report is anybody’s guess. Some packer have already discussed a $.50/lb increase in Chandler Halves and Chandler LHP. It will take several weeks for buyers and sellers to settle in on prices that both can agree on.

Chile

Crop size is expected to be around 145,000 tons higher than last year’s 135,000 tons. Size, colour and yield are much better this season. Chandler inshell shipments has started 2-3 weeks ago but container availability has been an issue, kernels will start sailing at the end of the month.

Chandler 30mm+ is between $2.7-$2.80/kg CFR. Chandler 20% LHP is around $6.50/kg CFR, 80% LHP is $7.8/kg CFR and hand cracked is between $10-10.50/kg CFR.

USDA Walnut Commitments

CWB reports USDA domestic buys of 15.3 million pounds which we assume are part of the 96,787,866 shelled pounds that they report for “shelled commitments”. This year, the USDA has heavily supported the California Walnut Industry and there is an additional solicitation on the table that purports to use an additional 275K to be announced in the coming week. We believe that the USDA programs to use walnuts will be ongoing.

Transportation and Logistics

While every packer still has export logistics issues, packers report steadily moving through their shipment backlog. April 2021 export shipments were up 28.4%. May 2021 will likely be strong thus most likely helping take the sold/committed position to over 95%.

Frost Damage and Hail Damage

We are hearing reports of frost damage most likely from a cold spell back in November 2020 which hurt many trees just after harvest. Many limbs of those trees did not develop foliage and those that did develop foliage did not have many “catkins” on those limbs for pollination. There are some reports of hail damage from our last cold/rain spell about a month ago and at least one grower has resorted to crop insurance as their crop looks 60-70% short. You may begin to see more reports of this.

CONCLUSION

What more is there to say than the California Walnut Industry has sold or committed to sell 91.6% of the crop? Cancellations of contracts due to the shipping delays has been minimal and with prices up from the lows (prior to this report) by about 10%, cancellations are unlikely. Chile has started shipping their inshell couple of weeks ago and will be shipping kernels end of the month which should take a little pressure off the world demand but they will be keenly aware of the California situation. Chandler Halves are nearly impossible to find and those packers with Chandler LHP will be looking to raise prices. This then will most likely drag up the price of Domestic LHP and also CHP. With the new commitment line in the CWB report, we will delve into this number to see how accurate it is but it seems that the amount is understated since we have heard from 3 packers that never put in their commitment number. But, could it also be overstated if packers are not accountable to provide a good number? That will have to be discussed as to how the CWB comes up with the commitment number and what deterrents they have in place for packers not to embellish.

For now, we have a number that is a bit shocking at 91.6% sold/committed. How high will prices climb due to this report and can a buyer actually get an offer going forward? It will take some time for the dust to settle but this is the report that the packers surmised was coming and they are not surprised by the numbers and now they will ponder their next move on pricing and offerings. Don’t be surprised at limited offers for several weeks.