FEBRUARY 2021 WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

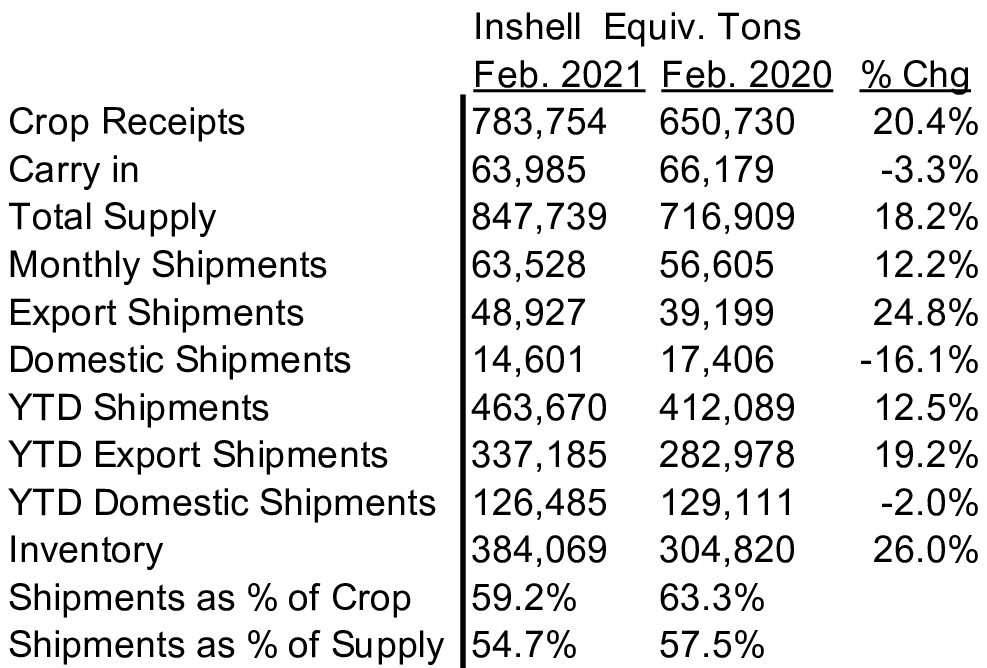

The California Walnut Board released the Feb. 2021 Position Report. Our table of these figures are shown below:

MMR

This is the 6th month of the 2020-2021 walnut season. Receipts are 783,754 inshell ton compared with the prior year at this time of 650,179 inshell ton and compared to the estimate of 780,000 ton. Shell out rate is estimated at 43.7% this year versus 42.6% last year.

– Quality this year was only fair for Chandler making it more difficult to pack J-Spec and K-Spec quality and thus adding to tonnage in domestic LHP and Combo H&P.

Monthly February inshell (total) equivalent shipments 12.2% vs. PY

– Export inshell equivalent shipments +24.8% vs. PY

– Domestic inshell equivalent shipments -16.1% vs. PY

February domestic sales were -16.1% of which Inshell was down -21.6% and kernel was down -13.92%. Export carried the month and helped significantly up 93.3% in inshell sales and up 13.05% in kernel sales. Monthly export inshell was led by Turkey (up 331.7%), Italy (up 127.5%), Germany (up 2,599%), UAE (up 511%) and Spain (up 228%). Packers continue to struggle to get goods shipped with the lack of vessels and containers being an issue so the month could have been even better. Incoming vessels are having a difficult time to get berth space and these delays are exacerbated by delays in off-loading containers due to the lack of trucks available. We have also heard of vessels heading back to Asia with empty containers so that the steamship lines can save fuel to Asia and then those containers get filled with goods coming back to the USA. It is a vicious cycle that does not seem to be waning any time soon.

YTD September 2020 – February 2021 +12.5% vs. PY

– Export inshell equivalent shipments +19.2% vs. PY

– Domestic inshell equivalent shipments -2.0 vs. PY

While the 6 month year to date total is up 12.5%, the crop is up 20.4% so the shortfall is concerning. Export Inshell was up 29.45% led by Turkey up 24.1%, Pakistan up 148 fold over the previous year and India up 129%. We are starting to get offers of “hand cracked in Turkey” USA origin kernel CFR East Coast, which is something to watch. On the kernel side, domestic kernel was up just 0.21% while export kernel was up 14.25%. Domestic kernel and inshell was disappointing and with Export inshell pretty much over, the domestic kernel and export kernel market must pull their weight.

6-month shipment assessment – Total Inshell equivalent shipments during the 2019-2020 first 6 months last year were 412,088 inshell ton compared with 463,670 inshell ton so far this year. This means the remaining 6 months last year averaged 40,139 ton to leave a carryout of 63,985 ton. Now, for the remaining 6 months, you’d have to average 64,011 ton each month to leave the same carryout. This is an increase of 59.5% which is unlikely. Last year, during the months of March 2020 – August 2020, the industry shipped 239,738 inshell ton. Here is a chart of possible carry out scenarios using last year’s March – August 2020 shipments as a guide:

Inventory as of February 2021 = 384,069 less <239,738 ton plus 0% > = 144,331 ton carry out

Inventory as of February 2021 = 384,069 less <239,738 ton plus 10%> = 120,357 ton carry out

Inventory as of February 2021 = 384,069 less <239,738 ton plus 12.5%> = 114,363 ton carry out

Inventory as of February 2021 = 384,069 less <239,738 ton plus 15%> = 108,370 ton carry out

Inventory as of February 2021 = 384,069 less <239,738 ton plus 20%> = 96,383 ton carry out

Chile

Chile started harvesting Serr this week and crop is coming in slow due cooler temperatures. Quality is expected to be much better than last year’s in terms of colour, size and yield. Chandler harvest will begin around mid-April. Crop size is expecting to be around 150,000 tons vs 135,000 tons shipped so far from 2020 crop. Delayed shipments from California has resulted in slow start to Chile’s 2021 season. After last year’s poor quality of inshell many buyers in India, Morocco, Turkey and Dubai prefer to wait for the harvest before choosing the best lots to buy.

Chandler and Serr inshell prices for: 30mm+ is $2.70/kg CFR, 32mm+ is $2.95/kg CFR and 34mm+ is $3.15/kg CFR. Chandler 80% LHP is between $7.30-7.50/kg CFR and hand cracked is between $10-10.50/kg CFR.

Current Inshell and Kernel Prices

J/L Chandler $1.00/lb, Jumbo Chandler $1.05/lb. Chandler LHP 20’s currently in the $2.40/lb to $2.45/lb range with limited supply. Domestic LHP is $2.20/lb to $2.30/lb range. Combo Halves and Pieces in the $1.85/lb to $1.90/lb range. Chandler halves $3.30/lb to $3.40/lb range if you can get an offer. Most of the inventory remains in the form of Domestic LHP and CHP.

CONCLUSION

The February 2021 Walnut MMR was surely disappointing especially from a Domestic standpoint. Exports did their fair share, Domestic did not. With Export inshell pretty much being done, Domestic needs to step up. Again, there are 3 key questions that we still don’t know the answers to:

1) Walnut Commitments – There is no data to get an understanding of commitments on the CWB MMR. Packer’s commitments are not on the report and there is no good way to assess this number. There could be lot of inventory or a little. Packers are dealing with delayed shipments due to container and vessel issues and inventory not shipped still shows as inventory not sold. Those sales still maybe good sales or could become problematic down the road. When do buyers start to ask out of those commitments? Packers we deal with are within 5-10% of being sold out.

2) Transportation and Logistics – Vessel and container issues are plentiful and not in a good way. Packers are desperate to move out goods and turn those goods into cash but they are not in control of this out of control situation. Cold storage season will come in April as well as space issues that will really add cost and frustration.

3) USDA Walnut buys – Will there be any more USDA walnut buys? The USDA just recently concluded an 8.6 million pound solicitation of Walnuts through the end of August 2021 along with other buys of almonds, trail mix, raisins, cranberries and prunes. The walnut buys have significantly helped the low end of the market as the quality of this years’ crop was poor adding to low end quality tonnage. The USDA walnut buys would seem to begin anew for new crop but you never know.

So where are we really? The Walnut Industry has shipped 59% of the crop. But, what is packed and awaiting vessels and containers and what are the remaining commitments that still have to be packed and then moved out?

Chile is trying to find their footing. Their Chandler inshell is not cheap but we hear offers from Chile every day and in some cases a bit lower than the previous day. Chilean product will be 6 months fresher than anything California has to offer.

Nothing is any clearer this month compared with last month’s report. Questions still abound regarding walnut commitments and transportation issues but Covid-19 vaccine progression and USDA buys have been helpful. The sentiment is mostly nervousness amongst packers due to a higher than normal projected carry out and trepidation that some export sales will get cancelled right in time for the cold storage season to begin.