February 2020 WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

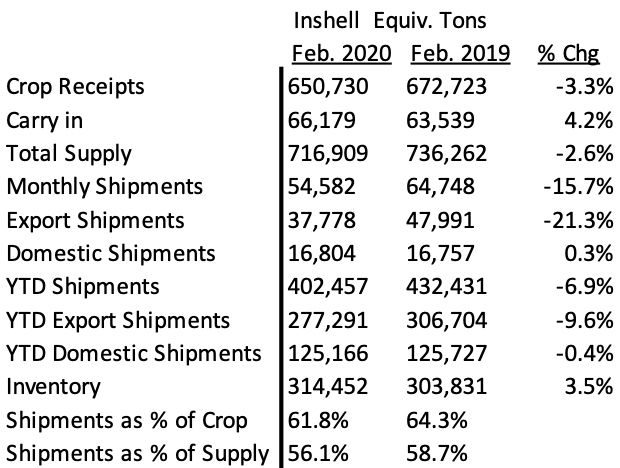

The California Walnut Board released the Feb. 2020 Position Report. Our table of these figures are shown below:

MMR and YTD HIGHLIGHTS

1) Monthly inshell (total) equivalent shipments -15.7% vs. PY

– Export inshell equivalent shipments -21.3% vs. PY

– Domestic inshell equivalent shipments up 0.3% vs. PY

2) Year to date inshell (total) equivalent shipments -6.9% vs. PY

– Export inshell equivalent YTD shipments -9.6% vs. PY

– Domestic inshell equivalent YTD shipments -0.5% vs. PY

4) Monthly inshell only shipments -61.02% vs. PY with Domestic -57.78% and Export -61.08%

– Key highlights include Turkey -81.7% vs. PY, Italy -59.8%, UAE -93.9%, Vietnam up 221%, India +196.0%

5) Monthly kernel only shipments +.81%% vs. PY with Domestic +1% and Export +.7%

6) Year to date inshell only shipments -18.43% vs. PY with Domestic -36.3% and Export -17.6%

– Key highlights include YTD inshell shipments to Turkey -3.9%, up 15.66% to India, -39.65% to UAE, +7.5% to Vietnam, +19.5% to Germany, +1.25% to Italy (which might be distorted since there are loads shipped to Italy which may need to be resold), +4% to Spain, -99.7% to Pakistan.

7) Year to date kernel only shipments -1% vs. PY with Domestic +1.14% and Export -2.6%

Both year to date kernel and monthly kernel shipments are very close to being on par with last year. Inshell only shipments have declined substantially for the month and year to date continues to fall further behind at -18.43% YTD.

MMR DISCUSSION

February’s report continues the negative industry trend now for the past two months..…..a slowdown in sales across the board. To be blunt, Inshell has fallen off the map and many packers are resigned to the fate that they may need to crack out remaining inshell. There will be concerns from full service packers of those packers that focus predominantly on inshell. These packers tend to not have a good handle on kernel sales and will delve into selling kernel with price as their only differentiation tool.

Crop receipts of 650,730 inshell ton is only -3.3% from PY 672,723 inshell ton receipts with total supply -2.6% vs. PY.

With 2 down months in a row, YTD inshell equivalent sales are -6.9% on crop receipts that are behind 3.3% Some packers have said that March should be a good sales month as the large price decreases put decent sales on the books for March 2020 shipment. We will see.

Another question mark is China. How is China’s large crop and significant export sales being negatively impacted due to the Coronavirus? Have they been able to ship? Are there cancellations? Will these goods have to be sold cheaper into other markets?

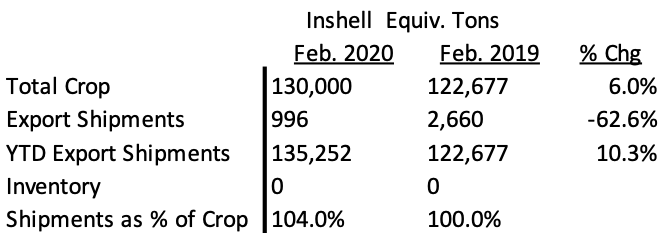

Chilean Walnuts

Chilenut released the February Position report with year to date shipment of 135,252 tons compared to last year of 120,334 tons an increase of 10.3%. For the crop year of 2019; UAE up 97%, Turkey down 22%, China up 76% and India down 32% compared to last year.

Chilenut has announced the 2020 Chilean walnut crop estimate as 137,000 tons which is exactly the same crop size as last year. Serr harvest started on Friday and Chandler harvest is expected to start on 1st week of April. Initial reports on Serr is showing 65% of the walnuts are between 30-34mm. 36mm+ will be very limited this year and currently no offers are available for this size. Historically Chile had 8-10% of their walnuts below 30mm and this year its expected to be anywhere between 15-25% to be below 30mm due to drought in Chile

Chile is currently offering Serr and Chandler between $2.90-3.05/kg CFR. Buyers are anxious about the quality and would prefer to wait for the harvest before choosing the best loads to buy. Seller are reluctant to offer until walnuts are in the warehouses. The uncertainty in size and crop size has resulted in slow start to the season and Chile is expected to have longer season similar 2018. India and Morocco by far have been the biggest buyers of Chilean walnuts so far while Dubai and Turkey are yet to finish their American walnuts.

Inshell Prices and Kernel Prices

Inshell prices for Jumbo/Large Chandler have recently been done in the $1.05/lb to $1.10/lb range. Large traders are actively bidding in the low $1.00 range. Chandler LHP 20’s currently in the $2.80 to $2.90/lb range. Domestic LHP is in the $2.70 – $2.80/lb range and Combo Halves and Pieces in the $2.60/lb to $2.65/lb range. Chandler halves are in the $3.10 – $3.20/lb range. Kernel sales are decently stable due to the decrease in prices. Inshell is very quiet. As we said last month, the quietness can be deafening and packers don’t like the sound of it and on top of that the normal “inshell only” packers will be cracking soon and will part of the sales mix. Cold storage season will be upon us in 1-2 months to add additional selling motivation.

Existing Inventory and sales position

As we mentioned last month, the California Walnut Board 2019 Orchard Run Production by County, Variety and Percent of Crop could easily lead us to believe that new crop will be +715,000 ton crop. This will be a pressure point as well.

Chandler material is still abundant. Combo is minimal and domestic light product is available but not plentiful. Most packers we talk to are 80% – 90% sold which still tell us that many packers we don’t deal with are undersold. Shipments are only 56.1% of supply. Upcoming months are normally slower with 2018-2019 sales (as an estimate) March – August sales being 239,738 inshell equivalent ton. If we assume this number for the 6 remaining months and subtract this number from existing inventory of 314,502 if would leave us carry out of 74,764 ton or an increase in carry out inventory of 13%.

What We Know and Don’t Know

– The crop is mostly final at 650,730 ton.

– Where is Chile at with their crop, quality prices and existing sales?

– Calif. Inshell sales going forward will be very slow. How will the cracking of this inshell inventory affect the kernel market. How will packers that are mostly in the inshell side of the business affect the kernel market?

– Where are we with the Coronavirus on Chinese exports of their walnuts? How will the virus affect other countries and their ability to make good on their contracts? We know of dozens of loads in Italy and in the Middle East being at risk and will this be the tip of the iceberg?

– Cold storage season will begin in April 2019 and will motivate packers to want to move goods out.

– Will there be another significant USDA Trade Mitigation Walnut buy to help the situation?

CONCLUSION

The February 2020 MMR report will not quell people’s fears much. We have seen packers who were once bullish, then neutral, now resigned. Other packer’s that are normally inshell sellers will now be in the kernel market and containers that are already afloat but with no home, will have to be sold at a discount. All this, with a looming large 2020 crop ahead. Hopefully the prior price reductions will propel good March kernel sales so the industry does not fall behind further. Using sales for last year for the next 6 months of 239,738 inshell ton, carryout would be about 75,000 ton or +13%.