AUGUST 2019 WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

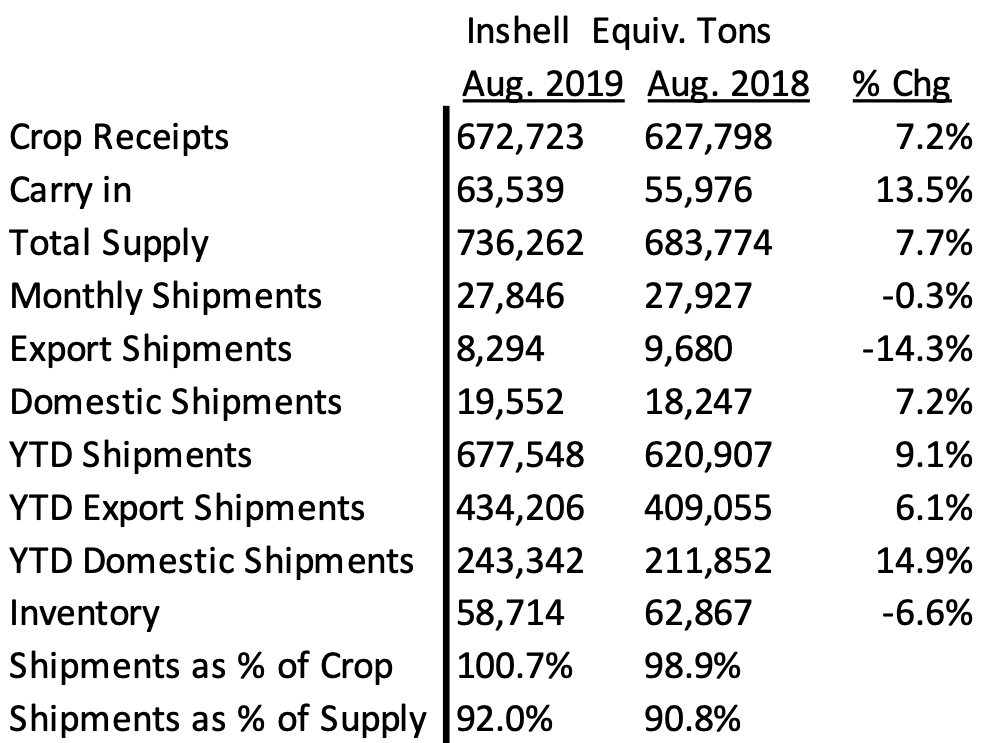

The California Walnut Board released the August 2019 Position Report. Our table of these figures are shown below:

The actual August MMR report came out on Monday, Sept. 9th but we elected to wait the week to gather further information from the Walnut Board meeting that occurred today.

MMR and YTD HIGHLIGHTS

1) Monthly inshell equivalent shipments flat vs. PY

– Export inshell equivalent shipments -14.3% vs. PY

– Domestic inshell equivalent shipments +7.2% vs. PY

2) Year to date inshell equivalent shipments +9.1% vs. PY

– Export inshell equivalent YTD shipments +6.1% vs. PY

– Domestic inshell equivalent YTD shipments +14.9% vs. PY

MMR DISCUSSION

The Calif. Walnut industry was up flat in August 2019 over PY. August’s shipments of 27,846 ton helped to sell out the 2018-2019 crop at 100.7% of the total crop. Carryout will be a very minimal 58,713 ton, down 6.6% from the PY. This was a very impressive 2018-2019 sales season. Of note, Turkish inshell YTD was up 9.06%, UAE up 120%, Italy up 13.3%, with India down 39.4%. On the Kernel side, Germany off by 22.5%, Spain up 15.6%, Japan off 11.5% and Korea off 3.5%. The overall excellent market performance was helped by favorable average prices and very favorable prices at the beginning of the season.

CHILE

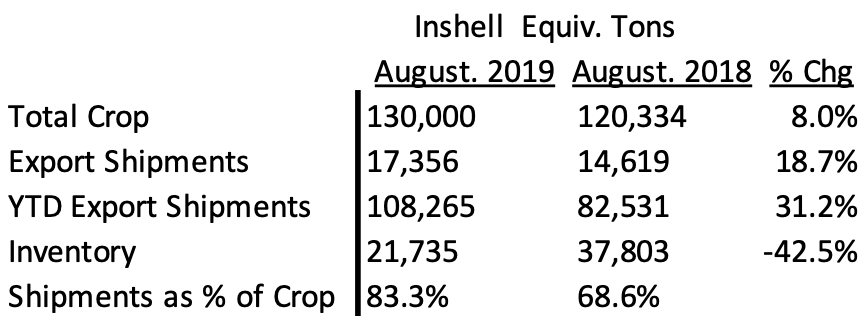

Chilenut released the August Walnut Position report with a shipment of 17,356 tons compared to last year of 14,619 tons an increase of 18.7%. August shipments are 6.5% lower than July’s 18,567 tons. For the month of August 2019; UAE up 21%, Turkey down 83%, China down 68% and India down 50% compared to last year. YTD shipments are 108,265 tons compared to 82,531 tons last year an increase of 31.2%.

Chilean inshell and halves are sold out. Only available material is medium and large pieces at $6.90/kg and $7.20/kg CFR. So far Chile shipped 83% of their crop. Remaining inventory is only 21,735 tons and this could take another month to clear the inventory. Chile will be a relatively non-factor to the California Walnut Industry until March/April 2020 when new crop prices commence to be discussed.

SUBJECTIVE AND OBJECTIVE ESTIMATES

The subjective estimate of 691,000 inshell ton put forth by the California Walnut Handler Coalition late July 2019 was then supplanted (to most pundits surprise) by the late August 2019 USDA estimate of 630,000 inshell ton or -8.8%. Comparatively, this new estimate is -6.3% from this year’s 2018-2019 crop of 672,723 inshell ton. Most people believe that if the walnut crop hits on all cylinders, there is a potential for 720,000 ton or more.

While this Objective estimate was a surprise to many, there were some prominent walnut packers and growers that had speculated that some late Winter frosts in 2018 had impacted their orchards. Ironically, the most recent Almond Industry Objective estimate of 2.2 billion pounds was off 12% from the Subjective estimate and might have been a possible clue to what might happen in walnuts as weather may have affected both crops adversely.

Follow-up California Walnut Handler Coalition Meeting

Following the Objective estimate on August 30th, the California Walnut Handler Coalition met late the following week and put forth suggested minimum prices for Jumbo/Large Chandler at $1.35/lb and Chandler LHP 20% at $3.20/lb. The sentiment was to leave room for the market to rise at a level they felt comfortable would not be susceptible to a large decline if the crop came in heavier.

Inshell Prices and Kernel Prices

Inshell prices for Jumbo/Large Chandler began around $1.15/lb over two months ago and most recently in the $1.35/lb to $1.40/lb range after the Coalition meeting. Inshell sales at this higher level has buyers, especially Turkey in a quandary over what to do. Without any in depth analysis, prices at these levels would be up approximately 30-35% over the average price of inshell Jumbo/Large Chandler last year.

The inshell price and the packer mentality of trying to “equate the same return to the grower whether the sale is Inshell or Kernel” has Chandler LHP 20’s at a $3.20 to $3.30/lb is the range of where packers would like to sell. Domestic LHP is in the $3.10/lb range and Combo Halves and Pieces in the $2.90/lb to $3.00/lb range. Again, without any in depth analysis, prices on kernel are about 20-25% higher than the average kernel prices of last year.

Existing Inventory

There is very limited inventory remaining. Most packers are sold out. New crop LHP and CHP should be available in 3-4 weeks with Chandler goods available in 5-6 weeks.

US Trade Mitigation Program

The latest USDA Trade Mitigation program for walnuts hit the street on 8/8/19 for 453,744 cases of 24/1lb product or 10.9MM pounds for shipment October 2019 through April 2020 and was successfully concluded. The US Government most likely will plan more buys and anticipation of those future buys will likely have fuel the Coalition’s thinking on price. Approximately 2/3 of the 14.9% domestic growth was actual growth in the domestic market and approximately 1/3 was due to the US Trade Mitigation program.

CONCLUSION – The 2018-2019 California Walnut season was a huge success by selling 100.7% of the crop. Chile should be a non-factor until further new crop pricing discussions in March/April 2020 as they have little product left to muddy the California waters today. Turkey and Dubai are empty and looking to buy inshell and while they have bought some at the higher price, they are currently less than enthusiastic at today’s prices.

Buyers are questioning the disparity between:

1) The decline in the estimated 2019-2020 crop by 6.3% (compared to the actual 2018-2019 crop) vs.

2) The approximately 30% price increase on inshell and 20-25% in kernel prices over last year’s average prices.

Thus, the current market for 2019 new crop seems poised to be a hand to mouth market. Buyers seem unwilling to contract at these levels with the belief that the crop will come in larger than the estimate and that prices today are overly inflated. It’s quite possible that average prices last year were overly deflated due to Chile being a major negative factor with their oversupply well into the late Fall of 2018 and the threat of widespread tariffs in many countries?

What will happen to the market when all handlers finally have the same commodity in house and when the “weight of the crop” is coming full force. Most packers have limited space and the industry as a whole is short on cold storage so that is a factor as well. Conversely, many buyers in their attempt to “wait out the market” could find themselves also in a short position at the time they need it most….for the holiday season. So who will blink first?

Can packers operate in a largely hand to mouth environment? Will overseas inshell buyers acquiesce and buy robustly helping put California in a stronger position and helping to increase prices? What is the actual crop size and will the actual crop surpass the estimate? Time will surely tell and may lead to a roller coaster of a ride but packers today have confidence in their ability to sell 630k ton coming off an impressive season where they shipped 677K ton.