Dec. 2018 WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

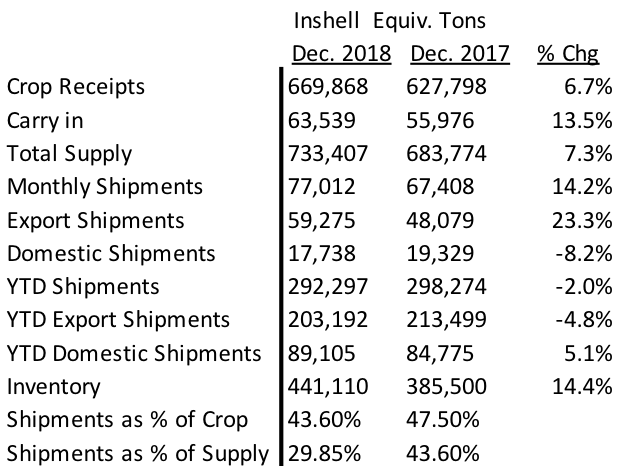

The California Walnut Board released the Dec. 2018 Position Report. For the month, Total December 2018 shipments were up 14.2% from prior year with Exports up by a significant 23.3% while Domestic shipments were down 8.2%. YTD shipments caught up a bit. While YTD November was down a total of 7%, YTD December 2018 was down a total of 2% (due to a strong December) with Exports down 4.83% and Domestic shipments up 5.1%. Our table of these figures are shown below:

IS THIS GLASS HALF FULL OR HALF EMPTY?

Well, a little bit of both.

– Crop Receipts increased an additional 11,0883 ton from 658,035 last year to 669,868 today while December shipments increased 9,604 ton. So, we gained a bit on sales but gained even more on receipts. Inventory is up 14.4%

– 2018 YTD sales of 292,297 ton is now only 2% behind last year but last year was a significantly lower supply, higher priced year. One would think that sales would be much higher, not lower than last year due to the cheaper prices.

– Export shipments YTD are off 4.83% but Domestic shipments are up 5.1%

– Combined Inshell shipments YTD are down 3.1% with Domestic inshell down 20.8% but Export Inshell shipments down1.8%. Positively, Export Inshell shipment for December were very strong up 62% so this has helped the industry in its effort to catch up to last year YTD sales. For December, Inshell sales to Turkey were up 71.83%, to Pakistan up 835%, to the UAE up 433% but to China/HK/India/Vietnam a combined 56% down.

– Combined Shelled shipments YTD are down 1.3% with Export kernel sales off 7.95% but Domestic kernel sales up 7.7%. Lower prices have help domestic kernel sales. Disappointingly, in some of our larger markets, Germany is down 47%, Japan is down 35.5% and Korea down 4.2%

– Chile will still be a staunch competitor to California. Chile will miss Ramadan sales for the foreseeable future and Chile typically will start offering in February and will start shipping Serr in April and Chandler in May. They are indicating at the moment that they will follow California pricing at the opening. Crop is looking good so far, with Chandler expected to be a little light on quantity of nuts but offset up by larger sizes, Serr crop looks heavy. Chile packers are now cheaper than California in most cases on kernels as they look to unload any remaining balances ahead of the new season.

– Commitments – Unlike the almond industry, the Walnut MMR’s do not include “commitments”. Many of the smaller and middle sized packers have reported shipments plus commitments of 80% plus. Invariably these packers are fairly bullish, satisfied in their position and hesitant to come up short in this market and thus very cautious. Is this reflective of the larger packers? Is there a two-tiered market where the small and medium packers are well sold and the larger packers are not well sold? Can the positions of these small and medium packers be that wildly divergent from the larger players? Is the lack of a “commitment” number in the report masking the possibility that all packers are fairly well sold and satiated in their positions? Eventually, the numbers have to tell the story and right now the situation through December is somewhat blurry.

Pricing for walnut material is as follows: Domestic LHP $2.35 – $2.50/lb, Export quality 20% LHP $2.50 – $2.65/lb. CHP is in the $2.20lb to $2.30/lb range with many handlers being very short of material. Chandler Halves in the $2.70 to $2.80/lb range. Inshell Jumbo Large Chandler $1.06 – $1.12/lb.

Conclusion – The market price hikes have been largely driven by Inshell demand for Chandler up about $0.15/lb from the low and up about $0.10/lb in the past month. This inshell demand has increased kernel prices commensurately. This month of December was strong up 14.2% helping the industry catch up a bit but still down 2% YTD. Shipments as a % of supply are 39.85%, down from 43.6% this time last year. As we’ve said, the question mark is commitments. Many packers that we speak with are over 80% shipped and committed but is that consistent with the entire industry? Eventually the truth will come out. Those commitments eventually turn into shipments and those shipments are reflective in the numbers. The month of December was good start and if the smaller and medium size packers positions are any indication of the large packer’s positions, then each successive month to come will begin to tell the story that the crop is well sold. In order to leave this 2018-2019 crop with the same carry out as the carry in coming into the crop, the Walnut Industry needs to sell an average of 47,000 ton each month for the next 8 months. This is what the industry sold last year: January 2018 55,000 ton, February 49,000 ton, March 50,000 ton, April 41,500 ton, May 41,500 ton, June 30,000 ton, July 27,000 ton and August 26,000 ton. This is an average of 40,000 ton with much higher prices on average.

So, for the walnut industry, does this December report portend that the glass is half full? Does the story begin to unfold and the numbers begin to reflect the large commitments that many packers have indicated? Are there some hidden secrets of large packers that are not well sold and waiting for their competition to sell out just to find out that they are one of many who did not sell? For now, due to a strong December the glass is half full, that is of course, until it’s not and the numbers don’t lie as they will always tell the truth.